Month: June 2023

-

Can private health insurance help with braces and orthodontics?

Are you considering getting braces or orthodontic treatment for yourself or your child? It’s understandable that you may have concerns about the cost, time commitment, and overall inconvenience of the process. However, it’s important to remember that corrective dental braces offer numerous benefits beyond just a perfect smile. They can significantly improve your oral health…

-

How to reduce your tax with Private Health Cover

Have you ever wondered how you could lower your taxes just by signing up for private health insurance? In Australia, we have something called the Medicare levy surcharge (MLS), which is a tax implemented by the Government to encourage people to use private hospitals alongside Medicare. This tax applies to individuals and families with higher…

-

The Essential Guide to Private Health Cover for Singles

As a single person, your private health coverage requirements may differ from those of a couple, single parent, or family. That’s why it might be beneficial for you to consider a singles policy that is specifically tailored to your current stage of life, overall health, income, and personal preferences. When it comes to safeguarding your…

-

Lifetime Health Cover Explained

Are you turning 31 soon or have you already passed that age milestone? If so, it’s important to know about Lifetime Health Cover (LHC) loading and how it may affect your private health insurance. Here we’ll explain what LHC is, how it works, and how it can impact your healthcare costs. We’ll also provide some…

-

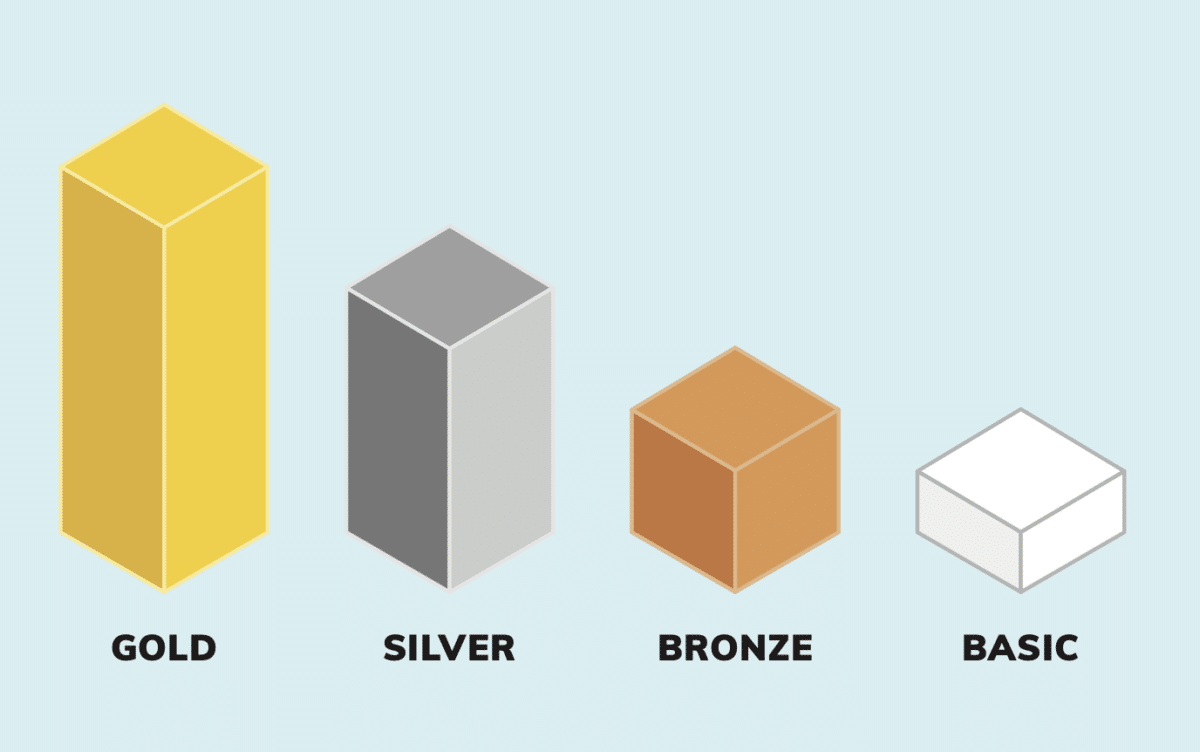

What do I get with my silver tier cover?

With many levels of private health hospital cover on the market today, it’s often difficult to know what level would suit you and your budget. If gold hospital cover is too expensive or you don’t need the inclusions, silver hospital cover is often a good middle-level coverage choice. Here we will compare private health policies…

-

The 4 most claimed Extra’s Benefits when it comes to Private Health Cover

When it comes to taking care of your health, having private health insurance is an excellent way to ensure you have access to the best care possible. But what about those extra health expenses that Medicare won’t cover? That’s where extras policies come in handy. In this blog, we’ll take a closer look at the…