If you’re in need of some dental work, minor or major, there are many options on the market with various private health providers that may offer the ideal rebate and solution for your oral care plan. Most of us put off a visit to the dentist for fear of the need of fillings or other work. Using your private health extras policy to claim each year on regular dental check ups may save you money in the long run. If you keep on top of dental checks and cleans, you may not need that filling.

Dental health insurance pricing can vary greatly from provider to provider, spend time researching and weighing up which extras policy that includes dental will be the best value for you and your family. If you are a single person maybe you only need basic dental cover, or if you have a family with 2 or more kids you would be better off with a more comprehensive plan to make sure everyone is covered.

Compare dental health insurance providers:

| Provider | Details |

| Bupa offers a range of dental extras to keep your teeth and gums healthy. With different levels to suit different dental needs, Bupa covers you from check-up and clean to major dental work such as crowns. Read more |

| Providing high-quality affordable treatment for a range of dental services, HCF will cover your child’s first visit to caring for your teeth when you’re older. HCF boasts a dental provider network of over 10,000 practitioners. Read more |

| NIB offer ‘First Choice Dental’ with their extras policies which allow you to access a range of treatments with their dental practitioner network. These practitioners offer treatments at agreed rates so you are not out-of-pocket. Read more |

| AAMI’s dental insurance offers various levels depending on if you require minor or major dental work. For instance if you require root canal work or removing wisdom teeth, this would be considered major dental work. Read more |

| HBF offers a 100% rebate on your first scale and clean each year, resulting in more money in your pocket. They offer cover for preventative dental, restorative and major dental and orthodontics. Read more |

FAQ

Are there waiting periods with dental insurance?

Waiting periods vary from private health fund to health fund, generally when you sign up for an Extras policy there will be a waiting period. A few other factors that can come into play are if you are a new customer to the provider. They may offer reduced waiting periods as part of a sign up promotion or depending on what dental treatments you require there could be extended waiting periods. It pays to shop around and compare dental health insurance plans.

How much can I claim on dental services with my private health cover?

By taking out Extras cover with your private health provider, some of the health funds have arrangements with dental health care providers to offer services to the members at a higher benefit rate than others. This is known as preferred providers and health funds recommend these dental providers to their members. This may result in ‘no out-of-pocket expenses’ or ‘reduced out-of-pocket expenses’.

Are dental treatments covered by Medicare?

If your family currently receives government benefits, you will find that your children can get bulk-billed for most dental services - these include:

- dental check-ups

- x-rays

- cleaning

- sealing cracked teeth

- dental fillings

- root canal treatment

- tooth extractions

Otherwise generally dental health care is not covered by Medicare, taking out an Extras policy with dental with your private health fund will help cover the costs.

What types of dental health care coverage comes with private health insurance?

Once you have taken out Extras cover with dental coverage, generally the following services are fully or partially covered:

- General check-up appointments

- Scaling and cleaning

- Basic fillings

- Extractions

- Flouride treatments

- X-rays

- Root canal therapy

- Crown and bridgework

- Orthodontics

If you are in need of major dental work like root canal therapy, crowns, bridges and orthodontics you will need to compare private insurance providers and check what level of cover offers the best rebates for these types of major dental services as this will vary from provider to provider. It’s also important to note that these major dental services may have longer waiting periods.

Are braces or Invisalign included with my dental cover?

Certain private health funds cover up to 80% for specialised orthodontic costs, speak to your health fund and compare extras policy and cover. Here are some health funds that offer this cover:

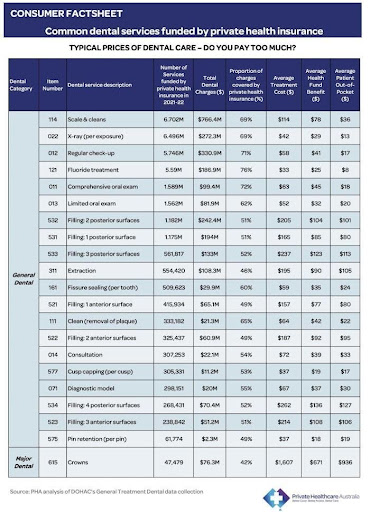

What is the average cost of each dental health care service?*

* Source: PrivateHealthcareAustralia.org.au

When it comes to dental health insurance, finding the right provider and policy can significantly impact your oral health care and financial impact. Whether you're an individual or a family, assessing your dental needs, present and future by comparing different dental health plans is essential to ensure adequate coverage. Each private health provider offers various levels of coverage, from basic check-ups to major dental procedures, with varying rebates and waiting periods. It's crucial to consider these factors such as preferred providers and out-of-pocket expenses to make your final decision. Remember, prioritising regular dental check-ups and cleanings can potentially prevent the need for costly treatments down the track. So, take the time to research and compare dental insurance plans that best fits your needs and budget, ultimately safeguarding your overall oral health.

Compare dental health insurance today and speak to one of our friendly team members about your options. Call 1300 861 413 or email hello@health.compare