When it comes to extras cover on your private health cover many of us ask the question is it really worth it? Do the benefits outweigh the cost? Extras cover is worth it if you use non-Medicare services on a regular basis. The value for money comes with the usage of your extras cover. For instance if you require glasses or contact lenses – optical extras cover is beneficial or if you play a sport you may require ongoing physiotherapy treatment. If you have children that require braces or dental work, having extras on your private health cover is worth considering.

Why should you take out extras cover?

This type of cover is useful if you require out of hospital medical services to maintain your health and wellbeing and improve your overall quality of life. You will find it covers physiotherapy and chiropractic services, prescription glasses and contact lenses, hearing aids, ambulance cover (depending on your state of residence) and some non-PBS pharmaceuticals depending on your level of extras cover and state you live in.

Need help choosing the correct level of extras cover?

There are a few factors that will come into play when choosing what extras cover you require such as budget and your specific health needs. Higher levels of cover are generally more expensive but offer a wider range of covered services. Depending where you are in your life stage, you may opt for this higher option or if you are younger and only require the basic services, basic extras may suit you.

Below are the areas of treatments that are covered when it comes to extras policies:

Each private health policy varies from provider to provider, so it’s best to compare private health cover to find the best extras policy for your needs.

| General Dental & Major DentalGeneral Dental Care: This includes routine check-ups, fillings, examinations, X-rays, and those refreshing scale and clean sessions. Major Dental Work: When things get serious, like needing crowns, surgical tooth extractions, bridges, dentures, wisdom teeth removal and veneers. Orthodontic Treatments: From the subtle alignment of Invisalign to the traditional braces and retainers, including their fitting and adjustments. Endodontic Services: This covers gum treatment and root canal therapy to keep those teeth and gums healthy and pain-free. |

| Optical (Glasses & contact lenses)Optical Needs: Whether it’s prescription sunglasses, eyeglasses, or contact lenses, ensuring you see clearly is a priority. |

| PhysiotherapyPhysiotherapy Sessions: Post-operative care and tailored exercises to keep your muscles in top form, whether for recovery or sports-related therapy. Hydrotherapy: Using specialist exercises that take place in a warm water pool to heal injuries and aid in rehabilitation. |

| Chiropractic/ osteopathy Remedial Massages: Soothing deep tissue massages or targeted treatments for sports injuries, helping you bounce back faster. |

| Massage/ natural therapiesChiropractic Care: From consultations and X-rays to gentle spinal adjustments, addressing musculoskeletal issues with a holistic approach. Chinese Medicine: This is a holistic approach to disease and focuses as much on the prevention of illness as the treatment of it. Acupuncture: You will be covered for acupuncture treatments working to restore health and wellbeing. |

| PodiatryPodiatry Services: Taking care of your feet and lower limbs, addressing everything from ingrown nails to bunions, crucial for athletes and those with mobility challenges. Orthotics Support: Customised shoe inserts to enhance natural foot function and alleviate discomfort. |

| LifestyleExercise Physiology: Utilising specialised exercises to aid in injury recovery, manage chronic conditions, and improve overall wellness. Psychological Support: Guidance from psychologists to tackle both mental and physical health concerns, with a focus on holistic well-being. Non-PBS Pharmaceuticals Coverage: Assisting with the cost of prescription medications not covered by the government’s Pharmaceuticals Benefits Scheme (PBS). Lifestyle Programs: Supporting approved courses aimed at enhancing your well-being, whether it’s quitting smoking, joining fitness classes, or managing weight effectively. Hearing Aid Services: Covering the purchase, repair, or replacement of devices to address hearing impairments. Dietician Consultations: Professional guidance on diet, nutrition, weight management, and disease control from recognised dieticians. Travel Vaccinations: Selected travel vaccinations administered by a doctor or at a vaccine clinic if you have a pharmacy receipt, doctor’s account or vaccine clinic account. |

| AmbulanceAmbulance Cover: Depending on where you live, considering ambulance cover is essential. Some health insurance extras policies include ambulance cover, but the extent of coverage can vary, so it’s worth exploring. |

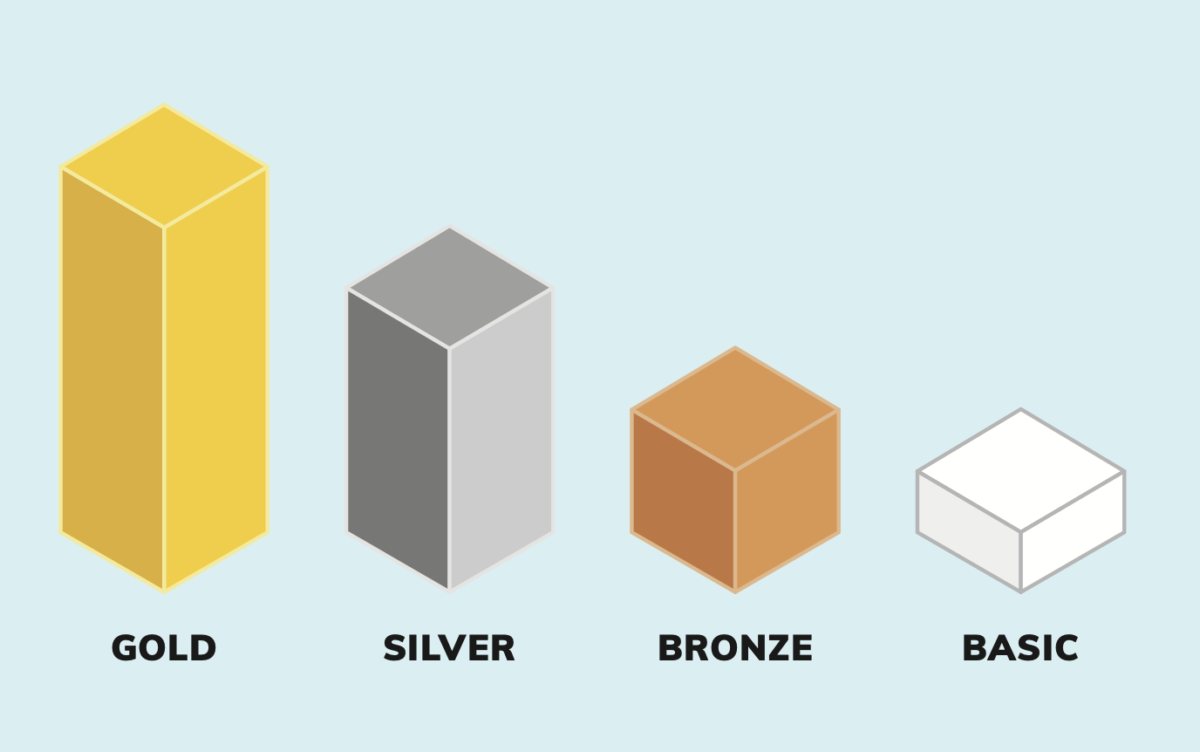

Extras Cover Levels Explained

There are basically three levels of extras cover that you can include on your private health policy in addition to your chosen hospital cover. Some providers also offer levels in between these three core levels for example – basic plus extras, medium plus extras etc.

Basic Extras Cover

This is basically your lowest level of extras cover that will cover:

- General dental

- Physiotherapy

- Optical

Medium Extras Cover

This level of cover usually provides good value for money. The medium level of extras cover generally include so or all of the following:

- General dental

- Major dental

- Endodontics

- Orthodontics

- Optical

- Physiotherapy

- Chiropractic/osteopathy

- Ambulance

Top Extras Cover

By choosing this level of extras cover you can have the peace of mind that you are covered for most health issues that may arise, such as:

- General dental

- Major dental

- Endodontics

- Orthodontics

- Optical

- Non-PBS pharmaceuticals

- Physiotherapy

- Hydrotherapy

- Chiropractic/osteopathy

- Podiatry

- Psychology

- Hearing aids

- Acupuncture

- Chinese Medicine

- Travel Vaccinations

- Ambulance

Extras Waiting Periods Explained

Each private health fund varies but some waive extras waiting periods if you move over to them, if you’re looking to move its best to do a private health cover comparison and see who can offer you the best value for money to suit your life stage.

When it comes to extras cover insurers can apply any waiting period they like. Some examples of extras waiting periods may be:

| General dental | 2 months |

| Physiotherapy | 2 months |

| Chiropractic/osteopathy | 2 months |

| Natural Therapies | 2 months |

| Optical | 6 months |

| Healthy lifestyle | 6 months |

| Dental special (periodontics, removal wisdom teeth, oral surgery, root canal, orthodontics, dentures) | 12 months |

| Orthotics | 12 months |

| Hearing aids | 36 months |

| Ambulance services | Immediately or 1-2 days |

Although for hospital services, private health funds must follow the Government guidelines for waiting periods and these waiting periods must be no more than:

- 12 months for pre-existing conditions

- 12 months for pregnancy and birth-related services

- 2 months for psychiatric care, rehabilitation or palliative care (even if it’s for a pre-existing condition)

- 2 months for all other services*

* Source: Health.gov.au

Remember to check your Extras Limits

Depending on your private health fund provider, each extras cover service will have a benefit limit per calendar year. Generally you can claim a certain percentage of the cost of that service up to a maximum limit set out by your private health fund.

Percentage Limits

Your private health fund may offer a percentage of the total cost of a service as a rebate. For example – your policy may cover 70% of your dental costs and you are responsible to pay the other 30% owing. This is called a gap payment. Alternatively, your policy may cover 100% of your new pair of reading glasses if the cost comes in under or equivalent to the annual claim limit.

Dollar Amount Limit

Some private health extras allow you to claim each service up to a particular dollar limit per service.

To conclude, navigating the large number of extras cover options can be overwhelming, but understanding your specific needs and comparing private health policies can ensure you find the best fit for your health and financial circumstances. Whether it’s routine dental care, physiotherapy sessions, or even lifestyle programs, extras cover can provide invaluable support in maintaining your well-being.

Remember, the key is to strike a balance between coverage and cost, ensuring you’re adequately protected without overpaying for services you may not need. By doing your research, considering your life stage, and consulting with experts, you can confidently choose an extras cover that complements your private health policy and gives you peace of mind.

If you need assistance navigating through the extras options or have questions about what’s best for you, don’t hesitate to reach out to our dedicated team to compare private health cover.

Call us today at 1300 861 413 or email hello@healthmarketing