This month we’ll explore why physiotherapy Extras are important when it comes to your private health policy and how to get the best out of your cover. Physiotherapy is the third most claimed extras cover in Australia. It can be beneficial for a range of conditions, including musculoskeletal injuries, chronic pain, and rehabilitation after surgery. With extras cover, your private health policy you can access a range of physiotherapy services including consultations, assessments, and treatments such as exercise therapy, massage and electrotherapy.

Why are physiotherapy extras important?

Physio focuses on improving your physical function and reducing pain. It’s a critical part of rehabilitation following an injury or surgery, managing chronic pain conditions, and maintaining overall physical health. However, the cost of physiotherapy can quickly add up, particularly for those who require ongoing treatment.

This is where your Extras part of your private health policy comes into play. With Extras cover, you can receive rebates on the cost of physio, reducing the financial burden on you and your family. Depending on your policy, you may also be able to access additional services such as chiropractic, osteopathy, and remedial massage.

Who has the highest claim level for physiotherapy?

Here’s some of the groups that have the highest claim levels for physiotherapy Extras in Australia:

- Those aged 65 and over – This group accounted for the highest number of claims and the highest overall cost of physiotherapy.

- Those with chronic conditions – Patients with chronic conditions such as arthritis, back pain, and sports injuries often require ongoing physiotherapy.

- Those with private hospital cover – Patients who have undergone surgery or been hospitalised for an injury often require post-operative physiotherapy as part of their recovery.

- Those living in regional areas – Patients in regional areas may have limited access to healthcare providers and may require more frequent or intensive physiotherapy treatment.

How to get the best out of your physiotherapy extras cover

If you have physiotherapy extras cover, there are several ways you can ensure that you’re getting the most value from your policy. Here are eight tips to keep in mind:

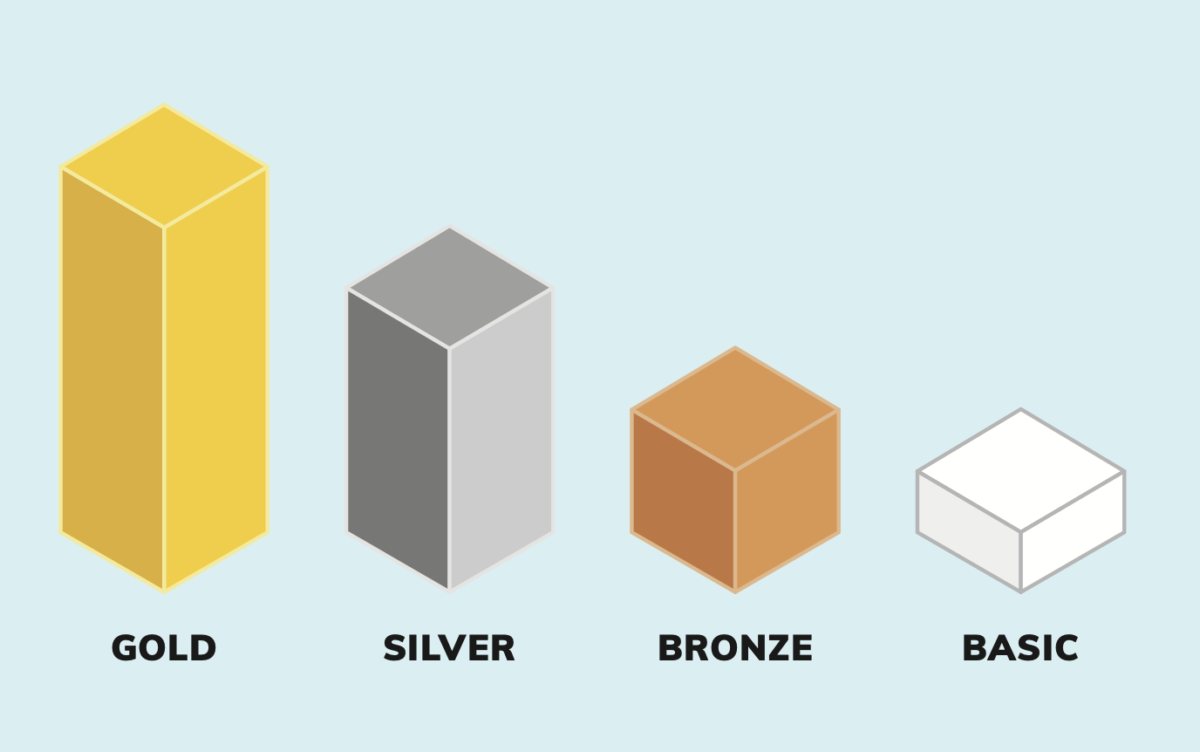

- Understand your private health policy – Take the time to read through your policy’s terms and conditions, so you know exactly what’s covered and what’s not.

- Choose a preferred provider – Many private health funds have preferred providers, who offer higher rebates and lower out-of-pocket costs. Find out if your physiotherapist is a preferred provider and consider switching if they’re not.

- Check the waiting periods – Most extras policies have waiting periods before you can claim benefits. Make sure you understand these waiting periods, so you’re not caught out.

- Don’t exceed your annual limits – Many private health policies have annual limits on how much you can claim for physiotherapy. Keep track of your claims throughout the year, so you don’t exceed these limits.

- Consider bundling policies – If you have other health needs, such as dental or optical, consider bundling your policies with the same health fund. This can often result in lower overall costs and higher rebates.

- Use your benefits regularly – Regular physiotherapy can help prevent injury and improve overall physical health. Don’t wait until you’re in pain to use your benefits.

- Keep your receipts – Make sure you keep all receipts and invoices for physiotherapy treatments, as you’ll need them to make a claim with your private health provider.

- Compare private health insurance – Finally, don’t be afraid to shop around and compare policies from different health funds. You may be able to find a policy that better suits your needs and budget.

In conclusion, physiotherapy extras are an essential part of any private health policy. It can help reduce the financial burden of physiotherapy treatment and promote overall physical health and well-being. By understanding your policy, choosing a preferred provider, and comparing private health plans before going ahead will assist in your wellness journey.

Compare private health insurance coverage today by visiting https://health.compare/ or speak to one of our friendly team members call 1300 861 413 / email hello@health.compare