Dental health is an important aspect of overall health and well-being, yet many people struggle to afford necessary dental care due to the cost of the treatment. Having dental as part of your private health insurance can help alleviate the financial burden you may incur from a trip to the dentist but trying to understand how it works can be confusing. In this blog post, we will discuss the basics of dental inclusions with your private health policy and how it can assist you pay for the proper dental care you need.

What is dental health?

⦁ Brushing your teeth twice a day with a fluoride toothpaste to remove plaque and prevent tooth decay.

⦁ Flossing at least once a day to remove food particles from between your teeth.

⦁ Visiting your dentist regularly for check-ups and professional cleanings.

⦁ Limiting your consumption of sugary and acidic foods and drinks to prevent tooth decay.

⦁ Don’t use tobacco products, which can cause tooth staining and gum disease.

⦁ Consider using an antiseptic mouthwash to kill bacteria and freshen your breath.

⦁ Wearing a mouthguard if you play sports to protect your teeth from injury.

⦁ Keeping your gums healthy by maintaining good oral hygiene, quitting smoking, and managing any chronic health conditions that can affect your gums.

⦁ Good nutrition is important for your overall oral health, eat a balanced diet with enough of key nutrients.

What is dental health cover?

First, it’s important to understand that dental health insurance is not the same as regular private health insurance. Dental health insurance, also known as dental coverage or dental benefits, is a separate extras policy that is designed specifically to cover the cost of dental care and makes up part of your private health insurance.

There are two main types of dental cover available: private dental insurance and public dental cover. Private dental insurance is purchased by individuals or families as part of your private health insurance policy, while public dental insurance is offered through state-funded programs and is available to certain groups of people or low-income individuals. Typically, Medicare does not cover most dental procedures such as teeth cleaning, dentures, wisdom teeth extraction, filling, or other routine procedures.

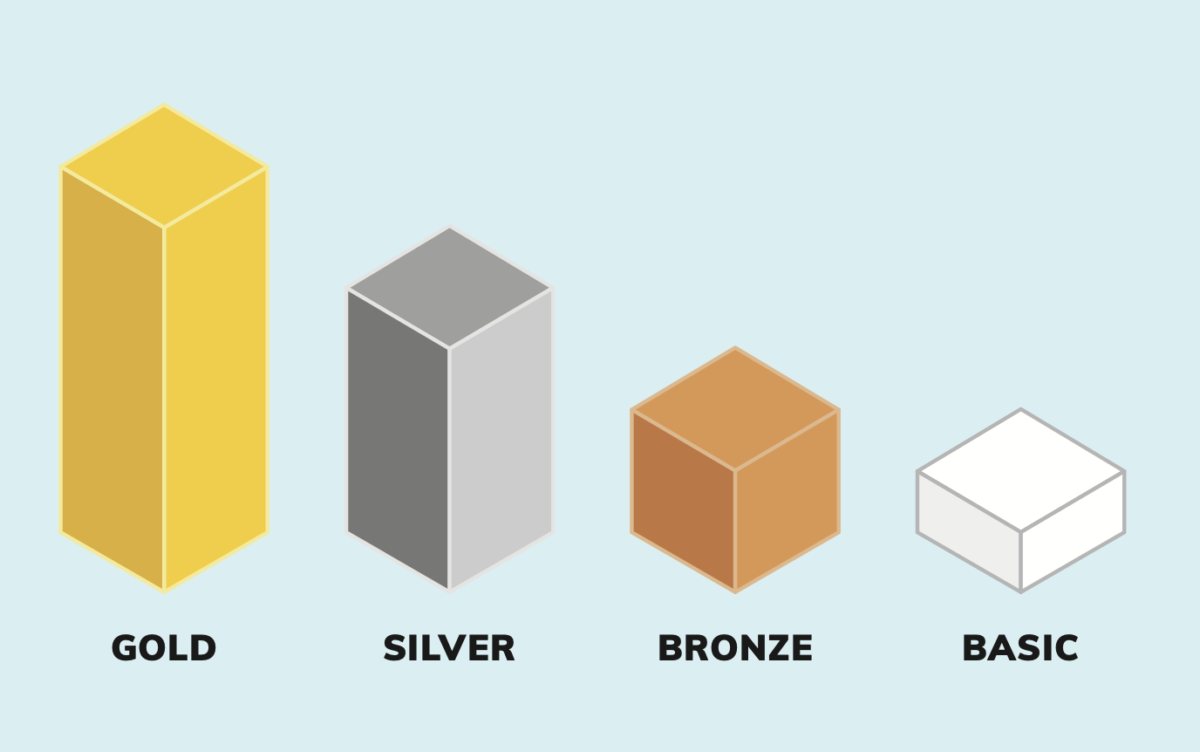

Your private health insurance extras cover typically includes a range of services which can be categorised into four main groups:

⦁ General Dental – oral exams, scale and clean, simple fillings, mouthguards, x-rays, and tooth extractions.

⦁ Major Dental – Tooth extraction, wisdom teeth removal, complex fillings, crowns and bridges, veneers, and dentures.

⦁ Endodontic – root canal therapy and periodontics which includes treatment of gum tissue diseases, infection, and inflammation.

⦁ Orthodontic – correction of teeth and jaws into the right position with braces or Invisalign.

How to Claim?

Claiming is simple, if your dentist is set up digitally and offer HICAPS – you can claim on the spot. Before booking any dental work and making a claim make sure that:

⦁ You’ve served the relevant waiting periods on your private health insurance policy to be able to claim.

⦁ The dental provider is a recognised provider with the health fund and has a provider number.

⦁ You have an itemised invoice that shows the provider ID and item number for the service/s, the charges and how much you’ve paid, and is dated within the last two years.

In conclusion, dental health insurance can help alleviate the financial burden of paying for dental care, but it’s important to understand how it works and what is covered. By comparing different plans and understanding the terms and limits of your private health insurance policy, you can make informed decisions about your dental health and ensure that you are getting the coverage you need. It’s also important to keep in mind that a good oral hygiene, healthy diet, and regular visits to a dentist can help prevent costly dental procedures in the future.

Find the best health coverage today

To compare private health cover that will work for you or speak to one of our friendly team members on 1300 861 413 or hello@health.compare