Waiting periods for private health insurance are normal, although they do vary when it comes to both Hospital and/or ‘Extra’s’ levels of cover, and can also vary by fund.

Let’s take a look at waiting periods across the board and guide you through the basics. For more detailed information on this, we recommend speaking to an expert who can help answer any additional questions. [click here to book a call]

What type of waiting periods can be found across the Private Health Industry?

Health insurance is split into effectively two categories: Hospital cover and Extras (This may also be referred to as general treatment or ancillary cover).

The waiting periods for Hospital cover are very different to those for extras. Let’s start with the waiting periods for hospital cover.

Hospital waiting periods are governed by the Private Health Insurance Ombudsman (PHIO) who outline what the maximum limits will be for specific hospital benefits. The good news is, no waiting period is longer than 12 months for coverage to start. For ‘Hospital Cover,’ the standard waiting periods are as follows:

• 12 months for pre-existing conditions or illnesses you showed signs or symptoms of in the 6 months leading up to taking out a hospital policy;

• 12 months for pregnancy and birth (obstetrics). This means you’ll need to consider health insurance for you and your unborn child before you fall pregnant;

• two months for palliative care, rehabilitation, and psychiatric care; and

• two months for other services that require hospitalisation (and aren’t pre-existing conditions or subject to other waiting times).

For more information on Pre-Existing conditions click here.

What about waiting periods on ‘Extra’s’ cover?

The waiting periods for ‘extra’s’ products are set by the health funds themselves and vary by each insurer.

Typically, health funds operate with similar waiting periods for general treatment and optical, that being 2 or 6 months. For more complex items such as major dental, hearing aids, or medical appliances, these waiting periods typically start at 12 months but can be longer depending on the fund. See below for more examples of typical waiting periods:

- 2 months for general dental benefits and physiotherapy

- 6 months for optical items, like glasses or contact lenses

- 12 months for major dental procedures, like crowns or bridges

- Up to 3 years for some high-cost procedures, such as braces and other orthodontics

Why does Private Health Insurance have waiting periods?

Insurers in Australia put waiting periods in place for a number of reasons, the first being governed by the Private Health Insurance Ombudsman (PHIO) and second to make pricing fair for all existing members. If hospital cover didn’t have a waiting period, people could effectively sign up to a level of cover, claim on an expensive service (such as major eye surgery) and then cancel the level of cover before paying anything significant.

By allowing this, the cost of Private Health Insurance would increase significantly, pricing out those wanting to join, as premiums would need to be adjusted accordingly.

I already have health insurance, what happens to my waiting periods?

Great question!

All waiting periods you have served/serving will transfer with you. This means you don’t have to restart waiting periods because you want to change policies or insurers. The only time a waiting period will apply is if you don’t have that service covered or you’re looking to upgrading your policy to include it moving forward.

An example of this would be:

|

Current Policy

Waiting Periods

|

New Policy

Waiting Periods

|

||

|---|---|---|---|

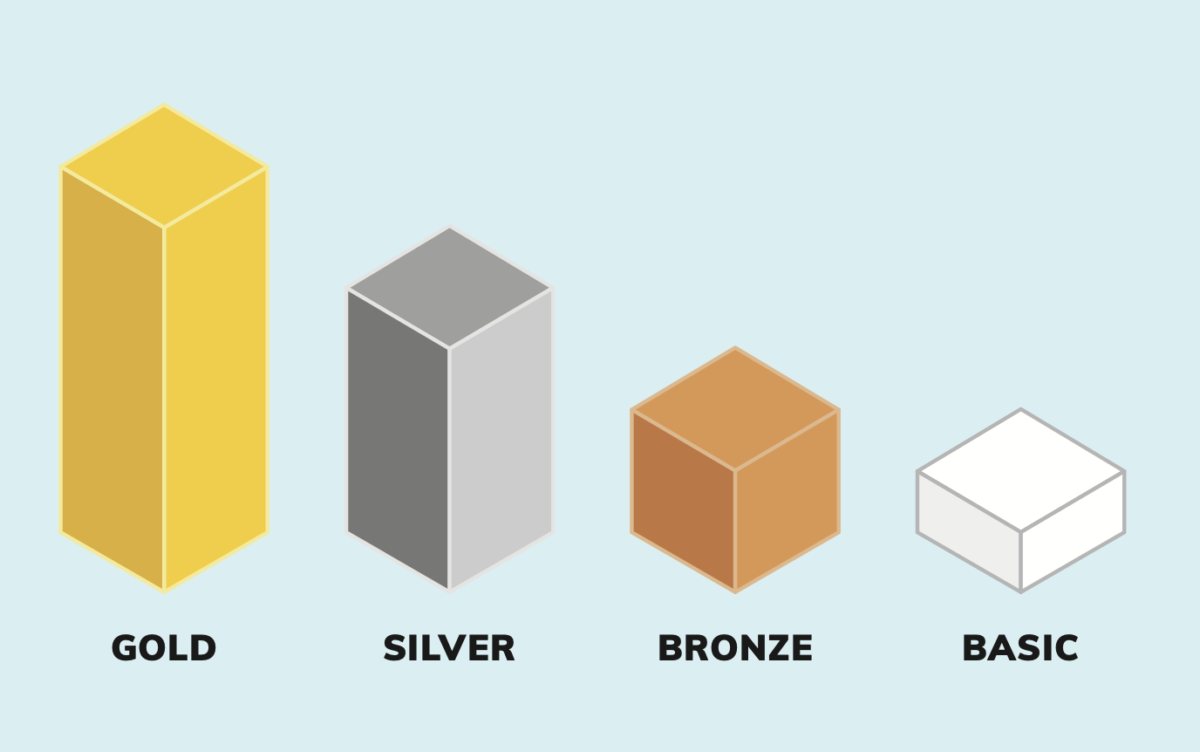

| Bronze Hospital | All Served | Bronze Hospital Different Fund |

No Waiting Periods |

| Bronze Hospital | All Served | Bronze Hospital New Fund |

No Waiting Periods for All Service

Waiting Periods for All Other Added Service

|

| Gold Hospital | All Served | Gold Hospital Existing/New Fund |

No Waiting Periods |

| Silver Hospital | 4 Months of Pre-existing Served | Silver Hospital New Fund |

Additional 8 Months for Pre-existing Cover |