With many levels of private health hospital cover on the market today, it’s often difficult to know what level would suit you and your budget. If gold hospital cover is too expensive or you don’t need the inclusions, silver hospital cover is often a good middle-level coverage choice. Here we will compare private health policies and the details of the inclusions of silver hospital cover.

A Silver health insurance policy typically provides coverage for a range of hospital treatments as a private patient. With this policy, you'll will be covered for all the hospital treatments provided in the Basic and Bronze policies, as well as clinical categories such as Heart and vascular system.

What’s included in silver hospital cover?

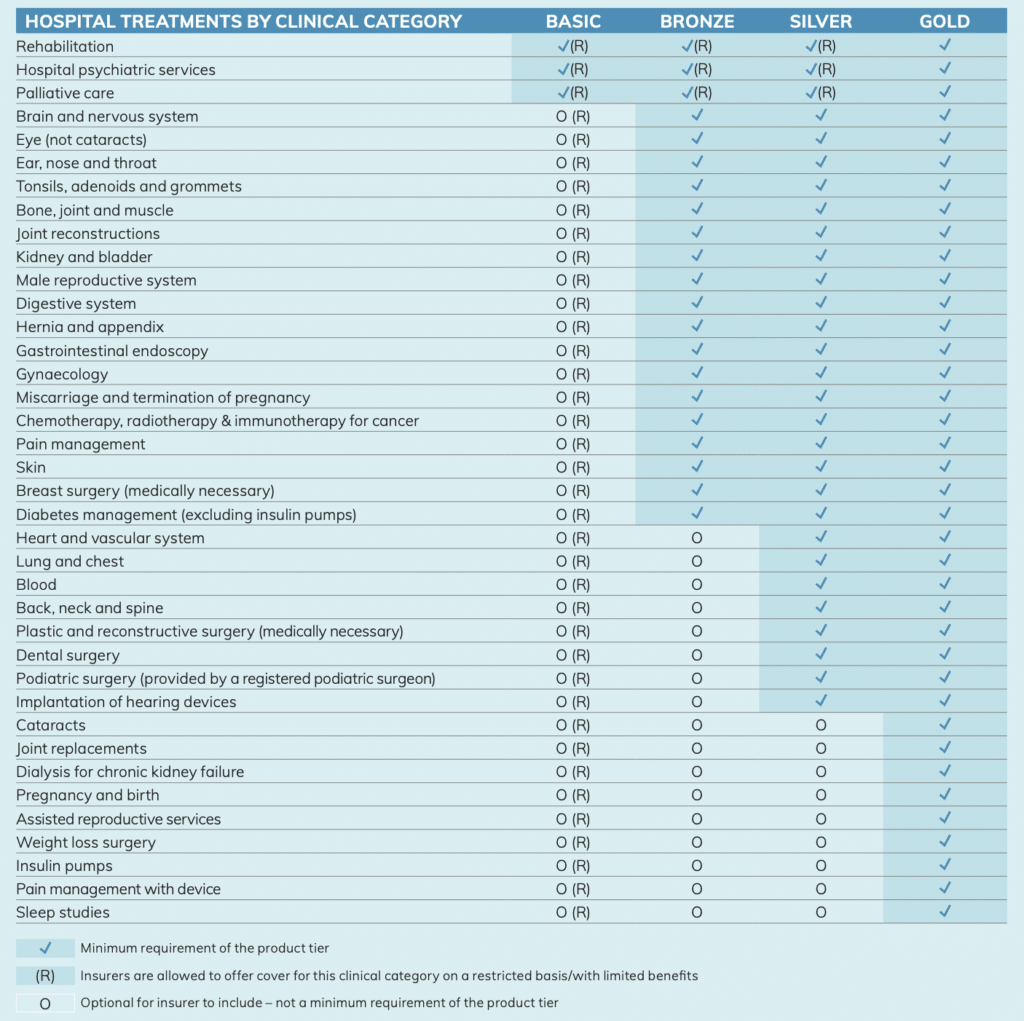

Silver health insurance is the second-highest tier of hospital product policies available, behind Gold hospital cover. If you opt for Silver private health cover, you'll receive the same minimum levels of coverage as Basic and Bronze policies as mentioned, with the added benefit of eight additional medical categories. These include cover for:

- Heart and vascular system

- Lungs and chest

- Blood

- Back, neck and spine

- Plastic and reconstructive surgery (if it's medically necessary)

- Dental surgery

- Podiatric surgery &

- Implantation of hearing devices

What is the difference between gold, silver, bronze, and basic hospital cover?

In case you're wondering about the difference between the four types of hospital cover available, let us break it down for you. In April 2020, the Australian Government mandated that private health insurers must categorise their policies into uniform tiers based on minimum service coverage requirements. These categories include Gold, Silver, Bronze, and Basic. Private health insurers must inform policyholders which category their policy falls under, allowing them to check if their cover aligns with their needs.

What isn’t covered under silver health insurance?

When you have a silver health insurance policy, there are certain hospital treatments that won't be covered. These exclusions are typically part of the gold tier, which offers more comprehensive coverage. Here are some of the treatments that your standard silver policy may not cover:

- Pregnancy and childbirth

- Pain management using a device

- Cataract surgery

- Joint replacement surgery

- Assisted reproductive services

- Sleep studies

- Dialysis for chronic kidney failure

- Weight loss surgery

- Insulin pumps

It's important to note that while these treatments may not be covered under a standard silver policy, some health funds may still offer additional coverage for them under a Silver+ or Plus policy. Keep in mind that this additional coverage may come at an extra cost.

Compare levels of private health cover

Below is a summary table of what hospital treatments are covered in each level of private health cover as set out by the Government.

Is silver tier private hospital cover worth it?

Silver tier private hospital cover offers numerous advantages, such as circumventing lengthy waiting times at public hospitals, providing financial benefits towards private medical procedures, and granting you greater flexibility in terms of where and when you receive treatment. In addition, it affords you and your loved ones a sense of security, safeguarding against unforeseen medical expenses. Therefore, it is worth considering investing in silver tier private hospital cover.

What are my waiting periods?

The maximum hospital waiting periods that health insurers can apply are set down in the Private Health Insurance Act 2007:

- 12 months for pre-existing conditions—this is defined as any condition, illness, or ailment that you had signs or symptoms of during the six months before you joined a hospital policy or upgraded to a higher hospital policy.

- 12 months for obstetrics (pregnancy)—to be covered, the mother’s hospital admission needs to take place after the 12-month waiting period has been completed.

- Two months for psychiatric care, rehabilitation, and palliative care, even for a pre-existing condition—this can include treatment of postnatal depression, eating disorders, and drug and alcohol rehabilitation, amongst other treatments.

- Two months in all other circumstances.

Do my waiting periods transfer if I change to silver hospital cover?

Yes, your waiting periods follow you when you transfer to a new private health fund. Within 30 days of switching, if you are coming from another provider, the new provider will acknowledge any waiting periods you have already completed.

Switching is easy.

If you're currently with another health fund and are considering switching, know that the process is much easier than you might think. By contacting Health.Compare we'll take care of cancelling your existing private health cover on your behalf, so you won't have to spend any time without coverage. Don't hesitate to make the switch today and discuss your hospital cover options with our friendly team.

Call us on 1300 861 413 or email hello@health.compare to compare health insurance silver tier hospital cover.