Navigating private health hospital cover can often be overwhelming, deciding what level of hospital cover you require can also be confusing. In this month’s blog we will dive into the details of gold level hospital cover and discover what you are covered for and is it really worth the investment.

When would I need Gold health Insurance?

There are a wide range of benefits covered with gold health insurance, although you may only need this level of cover if you require hospital psychiatric services, pregnancy cover, cataract eye surgery, Insulin pump for type 1 diabetes or a surgical weight loss procedure. If you need to be covered for these services, you will require gold hospital cover.

What is Gold health Insurance?

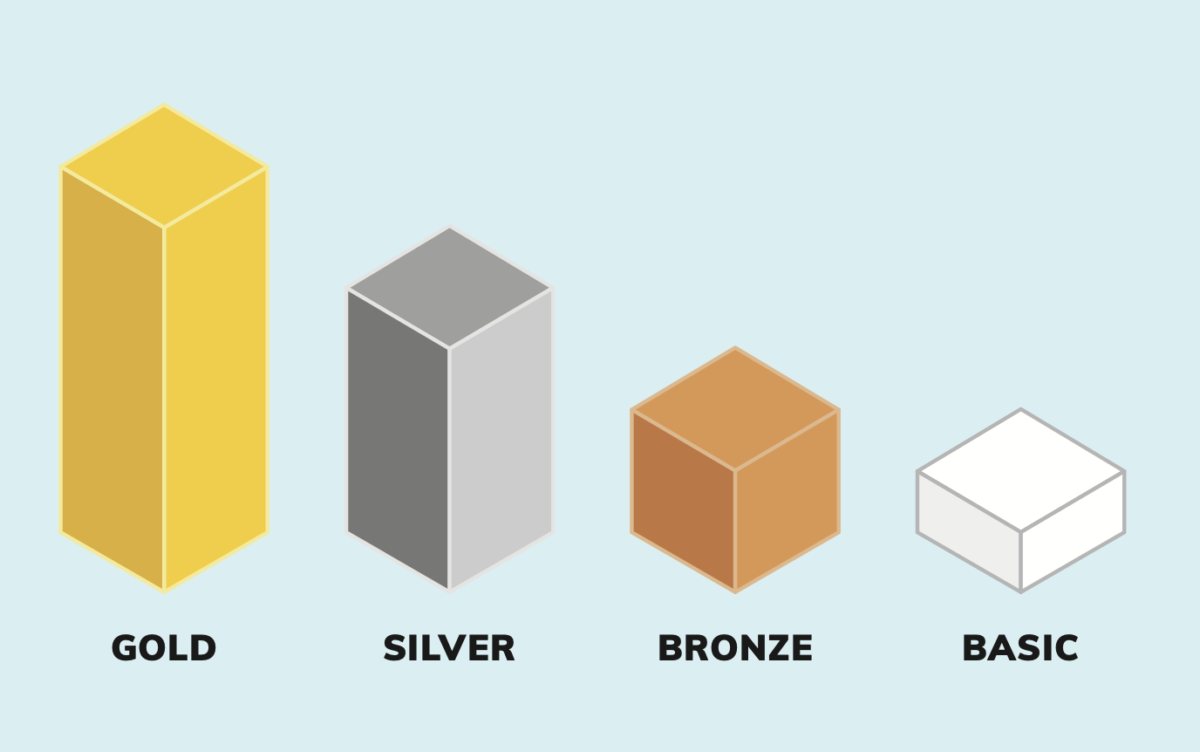

This is the highest level of private health cover available in a private hospital in Australia. Gold level health insurance cover offers full private health insurance, whereas silver offers medium cover, Bronze low cover and Basic very little cover. In 2019, the Australian Government brought in reforms to simplify private health insurance and one of these reforms was categorising all hospital policies into four tiers basic, bronze, silver and gold.

So what does Gold health insurance cover?

All of the following medical treatments are also covered required to be carried out as an inpatient in a private hospital when you take out gold health insurance cover:

| Hospital psychiatric services | Treatment and care of patients with psychiatric, mental, addiction or behavioural disorders. For example: schizophrenia, depression, eating disorders, addiction therapy, and post-natal depression. |

| Weight loss surgery | Surgery that is designed to reduce a person’s weight, remove excess skin due to weight loss and reversal of a bariatric procedure. For example: gastric banding, gastric bypass, sleeve gastrectomy. |

| Rehabilitation | Physical rehabilitation for any patient recovering from illness, such as stroke recovery or cardiac rehabilitation. |

| Palliative care | Providing quality of life care for a patient with a terminal illness, including treatment to alleviate and manage pain. |

| Brain and nervous system | The investigation and treatment of the brain, brain-related conditions, spinal cord, and peripheral nervous system. For example, stroke, brain or spinal cord tumours, head injuries, epilepsy, and Parkinson’s disease. This category does not include the treatment of spinal column conditions and chemotherapy or radiotherapy for cancer. |

| Eye (not cataracts) | The investigation and treatment of the eye and contents of the eye socket. For example: retinal detachment, tear duct conditions, eye infections and medically managed trauma to the eye. This category does not include cataracts, eyelid procedures, and chemotherapy and radiotherapy for cancer. |

| Ear, nose & throat | The investigation and treatment of the ear, nose, throat, middle ear, thyroid, parathyroid, larynx, lymph nodes, and related areas of the head and neck. This category does not include tonsils, adenoids, grommets, implantation of hearing devices, orthopaedic neck conditions, sleep studies, and chemotherapy and radiotherapy for cancer. |

| Tonsils, adenoids and grommets | Treatment of the tonsils, adenoids, and insertion or removal of grommets. |

| Bone, joint and muscle | Treatment for the investigation and treatment of diseases, disorders and injuries of the musculoskeletal system. For example: carpal tunnel, fractures, hand surgery, joint fusions, bone spurs, and bone cancer. This category does not include chest surgery, spinal cord conditions, spinal column conditions, joint reconstructions, joint replacements, podiatric surgery, management of back pain, and chemotherapy and radiotherapy for cancer. |

| Joint reconstructions | Treatment for joint reconstructions. For example: torn tendons, rotator cuff tears, and damaged ligaments. This category does not include joint replacements, bone fractures, spinal column procedures, and podiatric surgery. |

| Kidney and bladder | The investigation and treatment of the kidney, adrenal gland and bladder. For example: kidney stones, adrenal gland tumour and incontinence. This category does not include dialysis and chemotherapy and radiotherapy for cancer. |

| Male reproductive system | The investigation and treatment of the male reproductive system including the prostate. For example: male sterilisation, circumcision and prostate cancer. This category does not include chemotherapy and radiotherapy for cancer. |

| Digestive system | The investigation and treatment of the digestive system, including the oesophagus, stomach, gallbladder, pancreas, spleen, liver and bowel. For example: oesophageal cancer, irritable bowel syndrome, gallstones and haemorrhoids. This category does not include endoscopy, hernia and appendectomy procedures, bariatric (weight loss) surgery, and chemotherapy and radiotherapy for cancer. |

| Hernia and appendix | The investigation and treatment of a hernia or appendicitis. This category does not include digestive conditions. |

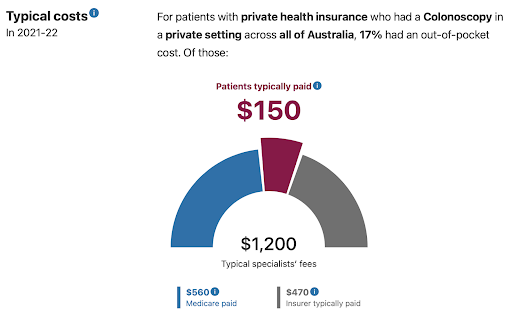

| Gastrointestinal endoscopy | The diagnosis, investigation and treatment of the internal parts of the gastrointestinal system using an endoscope (an instrument using a camera to look inside the body) For example: colonoscopy and gastroscopy. This category does not include non-endoscopic procedures for the digestive system. |

| Gynaecology | The investigation and treatment of the female reproductive system. For example: endometriosis, polycystic ovaries, female sterilisation and cervical cancer. This category does not include fertility treatments, pregnancy and birth-related conditions, miscarriage or termination of pregnancy, and chemotherapy and radiotherapy for cancer. |

| Miscarriage and termination of pregnancy | The investigation and treatment of a miscarriage or for termination of pregnancy. |

| Chemotherapy, radiotherapy and immunotherapy for cancer | Treatment for chemotherapy, radiotherapy and immunotherapy for the treatment of cancer or benign tumours. This category does not include surgical treatment of cancer, which is listed separately under each body system. |

| Pain management | Treatment for pain management that does not require the insertion or surgical management of a device. For example: treatment of nerve pain and chest pain due to cancer by injection of a nerve block. This category does not include pain management using a device such as an infusion pump or neurostimulator. |

| Skin | The investigation and treatment of skin, skin related conditions and nails. This category includes the removal of foreign bodies, and plastic surgery that is medically necessary and relating to the treatment of a skin related condition. For example: melanoma, minor wound repair and abscesses. This category does not include removal of excess skin due to weight loss, and chemotherapy and radiotherapy for cancer. |

| Breast surgery (medically necessary) | The investigation and treatment of breast disorders and associated lymph nodes, and reconstruction and/or reduction following breast surgery or a preventative mastectomy. For example: breast lesions, breast tumours, asymmetry due to breast cancer surgery, and gynecomastia. This category does not require benefits to be paid for cosmetic breast surgery that is not medically necessary. |

| Diabetes management (excluding insulin pumps) | The investigation and management of diabetes. For example: stabilisation of hypo- or hyper- glycaemia, contour problems due to insulin injections. Treatment for diabetes related conditions is listed separately under each body system affected. This category does not include treatment for ulcers or provision and replacement of insulin pumps. |

| Heart and vascular system | The investigation and treatment of the heart, heart related conditions and vascular system. For example: heart failure and heart attack, monitoring of heart conditions, varicose veins and removal of plaque from arterial walls. Also known as cardiac services. This category does not include chemotherapy and radiotherapy for cancer. |

| Lung and chest | The investigation and treatment of the lungs, lung related conditions, mediastinum and chest. For example: lung cancer, respiratory disorders such as asthma, pneumonia, and treatment of trauma to the chest. This category does not include chemotherapy and radiotherapy for cancer. |

| Blood | The investigation and treatment of blood and blood related conditions. For example: blood clotting disorders and bone marrow transplants. This category does not include treatment for cancers of the blood. |

| Back, neck and spine | The investigation and treatment of the back, neck and spinal column, including spinal fusion. For example: sciatica, prolapsed or herniated disc, and spine curvature disorders such as scoliosis. This category does not include joint replacements, joint fusions, spinal cord conditions, management of back pain, and chemotherapy and radiotherapy for cancer. |

| Plastic and reconstructive surgery (medically necessary) | Treatment which is medically necessary for the investigation and treatment of any physical deformity, whether acquired as a result of illness or accident, or congenital. For example: burns requiring a graft, cleft palate, club foot and angioma. This category does not include treatment of skin-related conditions and chemotherapy and radiotherapy for cancer. |

| Dental surgery | Hospital treatment for surgery to the teeth and gums. For example: surgery to remove wisdom teeth, and dental implant surgery. |

| Podiatric surgery (provided by a registered podiatric surgeon) | The investigation and treatment of conditions affecting the foot and/or ankle, provided by a registered podiatric surgeon. This is limited to cover for hospital accommodation and the cost of a prosthesis. Note that insurers are not required to pay for any other benefits for podiatric surgery, such as the surgeon’s fee or medical fees such as the anaesthetist, though they may choose to do so. |

| Implantation of hearing devices | Treatment to correct hearing loss, including implantation of a prosthetic hearing device. |

| Cataracts | Surgery to remove a cataract and replace with an artificial lens. |

| Joint replacements | Surgery for joint replacements, including revisions, resurfacing, partial replacements and removal of prostheses. For example: replacement of shoulder, wrist, finger, hip, knee, ankle, or toe joint, spinal disc replacement. This category does not include joint fusions, spinal fusions, joint reconstructions, and podiatric surgery performed by a registered podiatric surgeon. |

| Dialysis for chronic kidney failure | Dialysis treatment for chronic kidney failure (renal failure). For example: peritoneal dialysis and haemodialysis. |

| Pregnancy and birth | Investigation and treatment of conditions associated with pregnancy and child birth. Also known as obstetrics. This category does not include treatment for the baby (this is covered under the clinical category relevant to their condition), female reproductive conditions, fertility treatments, miscarriage and termination of pregnancy. |

| Assisted reproductive services | Hospital treatment for fertility treatments or procedures. For example: retrieval of eggs or sperm, In vitro Fertilisation (IVF), and Gamete Intra fallopian Transfer (GIFT). This category does not include treatment of the female reproductive system, and pregnancy and birth-related services. |

| Insulin pumps | The provision and replacement of insulin pumps for treatment of diabetes. |

| Pain management with device | The implantation, replacement or other surgical management of a device required for the treatment of pain. For example: treatment of nerve pain, back pain, and pain caused by coronary heart disease with a device (for example an infusion pump or neurostimulator). This category does not include treatment of pain that does not require a device. |

| Sleep studies | The investigation of sleep patterns and anomalies. For example: sleep apnoea and snoring. |

Source: Privatehealth.gov.au – Updated January 2024.

How does Gold health insurance stack up to Silver and Bronze cover?

If you take out Gold level cover this will include all 38 clinical categories. Gold health insurance policies include unrestricted cover for pregnancy, surgical weight loss surgery and hospital psychiatric services. This level of cover is the top-tier that has extensive coverage on many services.

Gold health insurance has 9 more clinical categories than Silver health insurance and 17 more clinical categories than Bronze health cover.

Who’d suit Gold tier cover?

Working out if gold health insurance cover is right for you is dependent on your situation. You may find one or more of the following items apply to you:

- You need assistance with weight loss in regards to a gastric banding

- You have diabetes and require an insulin pump

- You and your partner plan on becoming pregnant and want to have your baby as a private patient in a private hospital

- IVF treatment is required to assist in the start of your family

- You want the peace of mind to know you are covered for 38 categories of treatments

- You require a knee or hip joint replacement

- You suffer with chronic pain and require a device and pain management plan

- You have chronic kidney failure and require ongoing dialysis

- You suffer from sleep issues and require medical treatment

- You have or are developing cataracts and need surgery to remove

To conclude, the question of whether Gold health insurance is worth it ultimately depends on individual circumstances and healthcare needs. While Gold level cover comes with a higher cost, it also provides comprehensive coverage for a wide range of medical treatments and procedures, offering peace of mind in times of need. With benefits spanning from joint replacements to pregnancy and birth, Gold health insurance ensures access to top-tier medical care in private hospitals across the country.

To explore your options and compare hospital cover that best suits your needs, reach out to our friendly team members who can provide personalised guidance and support. Call us today at 1300 861 413 or email hello@health.compare to get started on securing your health and well-being.